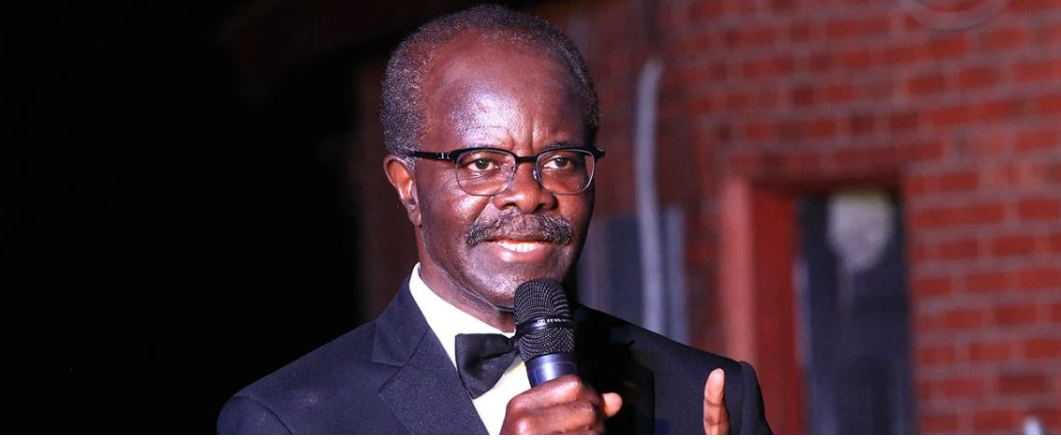

Dr. Papa Kwesi Nduom, Chairman of Groupe Nduom and former owner of the defunct Gold Coast Fund Management Company, has alleged that former Finance Minister Ken Ofori-Atta petitioned the Cabinet to facilitate the collapse of GN Bank to prevent any political interference.

According to Dr Nduom, the memorandum from the former Finance Minister requested the revocation of GN Bank’s banking license by the Cabinet.

He claimed that Ofori-Atta’s motive was to neutralize the bank and prevent it from being used to politically antagonize the ruling government.

“I have with me here a memorandum submitted by the Minister of Finance at that time, Mr. Ken Ofori-Atta, asking Cabinet to agree for GN Bank to be collapsed, for its license to be taken. This memorandum didn’t consider that this bank was the biggest bank with the widest distribution in Ghana.

“It didn’t recognize that we were providing banking services that increased financial inclusion in Ghana. It didn’t recognize that we were supporting financial development and economic development in Ghana.

“It just said, these people are causing us problems and therefore it might affect our political chances, so let’s shut it down,” Dr. Paa Kwesi Nduom claimed in a viral video shared on X formerly Twitter.

He revealed although the memorandum was presented to the cabinet, there was no consent to Ken Ofori-Atta’s request to revoke the bank’s operating license.

In 2019, under the government’s banking sector clean-up, GN Bank (which had become GN Savings and Loans), a company owned by Dr Nduom, had its operating license revoked over reasons of insolvency by the Bank of Ghana.

Meanwhile, Dr Nduom has asserted that the government still owes two of his companies and other subsidiaries an amount exceeding GH¢7 billion.

The Securities and Exchange Commission (SEC) had revoked the licenses of 53 fund management companies, including Gold Coast Fund Management, in 2019, leading to the freezing of depositors’ funds.

Despite ongoing efforts by depositors and investors to retrieve their funds, they have faced challenges in recovering their investments.

In a recent move to revitalize his companies, Dr. Ndoum has urged the government to reimburse contractors who had borrowed money from Groupe Ndoum.

“A debt that used to be GH¢1.8 billion is now more than GH¢7.1 billion. It is growing every day with interest. So the government of Ghana and its agencies, if they had paid us even one-third of that money to the contractors six years ago, there wouldn’t be a Gold Coast or Black Shield problem.

“There wouldn’t be a GN Bank problem, there wouldn’t be a problem with any of our companies. So today, what we are asking is we are saying let them pay the money. If the government doesn’t have the money, let us come up with a payment plan. They pay us, the customers get paid,” he said.

Source: tigpost.co