The Bank of Ghana (BoG) has made it clear that a person’s next of kin do not have an automatic right to inherit money from their bank accounts when they die.

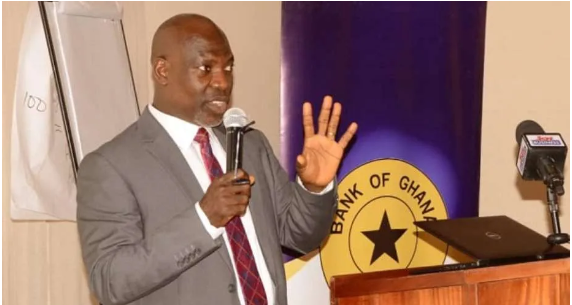

While speaking with reporters outside of a National Financial Education Campaign stakeholder workshop in Accra’s Oak Plaza Hotel on Tuesday, December 12, Augustine Amoako Donkor, Head of Conduct Supervision at BoG, revealed this.

Mr. Amoako Donkor stated that “The notion that the funds in accounts should automatically go to the next of kin if an account holder should pass away is wrong.”

Rather than inheriting the money outright, he clarified, next of kin are merely supposed to help the bank get in touch with the account holder.

“From what we know, the next of kin is supposed to assist the financial institution in trying to get in touch with the account holder,” said a BoG representative.

Banks must follow legal procedures before distributing funds to heirs, as pointed out by Mr. Amoako Donkor.

To combat the widespread lack of knowledge about personal finance in Ghana, the Ministry of Finance and other interested parties started the National Financial Education Campaign in April of this year.

Professionals agree that raising the general public’s level of financial literacy is essential if we want them to be able to manage their own money wisely and know their rights and responsibilities.

As the BoG noted during the workshop evaluation, it will also aid in challenging myths regarding matters such as the inheritance of bank accounts.

There will be less room for error in the system if every Ghanaian manages their own money.

Being the next of kin to a deceased person’s bank accounts can have both advantages and disadvantages, depending on the specific circumstances. Here’s a breakdown:

Advantages:

- Financial access: You may be able to access the funds in the deceased’s accounts to help with funeral costs, outstanding debts, or living expenses. This can be especially helpful if the deceased did not have a will or if their estate is not readily available.

- Simplified inheritance: In some cases, being next of kin can simplify the inheritance process for bank accounts, particularly if the accounts were held jointly or had named beneficiaries. This can be faster and less expensive than probate.

- Peace of mind: Knowing that the deceased’s financial affairs are in order and that their debts are paid can be a source of comfort and peace of mind during a difficult time.

Disadvantages:

- Legal complications: Depending on the size and type of the account, there may be legal requirements that need to be met before you can access the funds. This could involve obtaining a death certificate, letters of administration, or court orders.

- Tax implications: Depending on the value of the inheritance and your relationship to the deceased, you may be liable for inheritance taxes. It’s important to seek professional financial advice to understand your tax obligations.

- Debts and liabilities: You may be responsible for paying the deceased’s outstanding debts, including credit card bills, loans, and mortgages. Be sure to carefully review the account statements and consult a financial advisor before accessing any funds.

- Emotional burden: Dealing with the deceased’s financial affairs can be emotionally draining during a time of grief. It’s important to take your time and seek support if needed.

Additional factors to consider:

- The existence of a will: A will can specify how the deceased’s bank accounts should be handled, which may supersede the next of kin’s rights.

- Local laws and regulations: The laws governing inheritance and access to bank accounts can vary depending on your location. Be sure to research the specific rules that apply to your situation.

- Personal circumstances: Your own financial situation, emotional state, and capacity to deal with legal matters will also play a role in determining whether accessing the deceased’s accounts is the right decision for you.

It’s important to weigh the advantages and disadvantages carefully before accessing the deceased’s bank accounts. Seeking professional financial and legal advice can help you make informed decisions and navigate the process smoothly.